Quickbooks Bank Feeds Received Instead of Spent

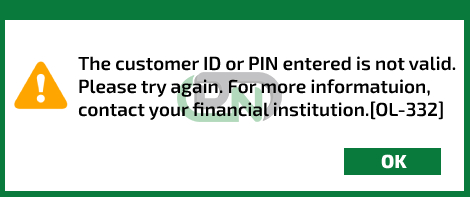

QuickBooks has so many impressive accounting tools that even big brands are banking on. One of the errors which may disturb your smooth work functionality in the QuickBooks is the QuickBooks error code OL-332. This error typically arrives at the time of accounts update. To simply put, it occurs when a QuickBooks end-user attempts to download the new bank transactions in the QuickBooks software.

Save Time, Reduce Errors, and Improve Accuracy

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

What can be the reasons behind error OL-332?

There are an array of responsible factors that can entail this error. We have listed them here. You need to look for the enlisted symptoms to see if you have landed in the same situation. Unfortunately, these are irking technical snags, which may obstruct your work for some time. However, a quick resolution will let you combat the same.

- This error can come up if the updated Version of QuickBooks is not in use.

- Inaccurate details or information saved in the application

- If there is a presence of malware or virus in the system.

- If the QuickBooks files have been deleted.

- The computer is not running properly and delay in response time

There are issues with the bank like:

- Acknowledgement required for pending alerts which are sent by the bank.

- Online banking is not running or inactivated

- Financial Institutions lacks the updated Banking information

- Instable Internet connectivity and outdated QB edition

- Non-compatible bank files

- Multiple bank accounts creation in the company file

Solutions: Quick Walkthrough

Method 1: Strengthen Your Internet Security

If you are encountering QuickBooks error OL 33, you are always advised to check the Internet Explorer settings and ascertain that you leverage the strong TLS 1.2 security protocol. The same can be opted by visiting the Internet Properties.

- Firstly hit on the keys Windows and R together.

- Once a Run dialog box is visible, write INETCPL.CPL.

- Tip: On the other hand, user can launch the Internet Explorer, navigate to the Tools and hit on Internet Explorer.

- Visit Advanced tab and thereafter go the Security.

- After that, mark a check for Use TLS 1.2.

- Press Apply followed by clicking on OK.

Reboot your PC once and thereafter initiate the downloading transaction process from the bank and look if the error persists.

Method 2: Test File Creation to Download Bank Feed Entries

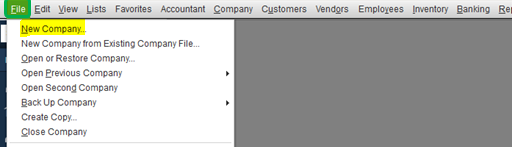

Another fixation method for OL 332 in QuickBooks Desktop is to generate a test company file so that you can verify if the transaction is being downloaded. To do so, pursue these instructions:

- Launch the QuickBooks program.

- Click on the File menu.

- In the next step, hit on the option of New Company & select the Express Start or Start Setup & Set up the Bank Feeds for the account.

- Hit on the Bank Feeds in the Banking option & Get the option of the Set up Bank Feeds for the account.

- After that, choose the bank.

Once you are done with the procedure, you can download the entries. If the error is still visible, connect with the bank immediately. Prior to that, you can give a try on other methods we are mentioning below.

- If you get an equivalent error: This typically means there is a drag with the network from the bank.

- If you don't get any error: This means that the matter is not together with the bank, and you ought to continue with readjust.

Method 3: Verify the Compatibility of Bank File with QuickBooks

When you download the bank entries, they can be seen only with the supported file format like .qbo file format. Users will end up seeing QuickBooks can't open the file if they are another file extension. In this scenario it is advisable to confirm the bank file extension and modify the file format if needed. To verify this, we will try downloading the bank entries. Here is how:

- Log in to your bank website.

- Find the bank entries to download in the .qbo file.

- After that, import the bank entries to the QuickBooks program.

If you are able to open the file in QuickBooks easily, it shows that the issue is with the bank website, not the file type. This will also ensure that the bank file is united with QuickBooks.

Method 4: Refresh the Bank Network

In this method, you need to disable online banking for inactive bank accounts. After that, refresh the bank network to get rid of the error. Adhere to the following given steps:

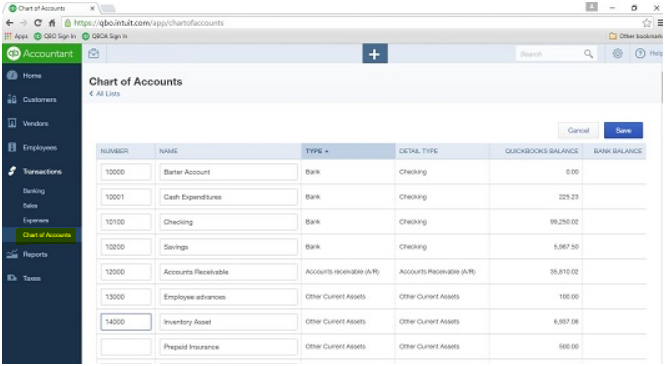

Verify If the Bank Account is Inactive

- Click on the Company.

- Navigate to the Chart of Accounts.

- Choose the Include Inactive box.

- Verify for the inactive bank account in the list. If there is any just turn them off.

Deactivate the Online Service

- Click right on the inactive account.

- Then, select the Edit Account.

- Click on the Bank Feed Settings.

- Post the above step, choose the Deactivate All Online Services.

- Hit the Ok button.

- Select the Save & Close button.

Once it is completed, the file can be closed and reopened. Along with this please ensure that there is no disclosure. This will secure that the error is taken off.

Important Note: While working on this procedure, please be ensure that you process the Ctrl key every time you select a button not while entering information. This will refresh the bank information.

Method 5: Merge Accounts

To get rid of the OL 332 in QuickBooks Desktop, you can make a copy of the account and then combine it with the old account. To do so, adhere to these steps mentioned below:

Create an Account

- Select the option of Chart of Accounts & Choose the impacted account and right-click on it.

- Then, choose the Edit Account button.

- After that, hit and copy the account name.

- At the end of your account name, add an asterisk (*).

- After that hit at the option of Bank Feeds Settings.

- Here you are required to select the option of Deactivate All Online Services.

- Hit OK.

- Click the Save & Close button.

- Here at this point, make a new account in the Chart of Accounts. At this stage, you can paste the account name you copied before while settings up the account name.

- Close the file and reopen it.

Merge Your Account with the Old One

- Move towards the menu Chart of Accounts.

- Post that, right-click on the account which has an asterisk mark.

- Select the Edit Account name.

- Now, delete the asterisk.

- Select the Save & Close button.

- Hit the Yes option to combine the accounts.

The above-given procedure will help you to create and merge the bank account. Here users can set up bank feeds and verify if they can easily download the entries.

If you are unable to edit the account or combine the account, it shows the company file is corrupted.

Method 6: Disable Other Banking Accounts

In this method, the user can give a try to disable the account and confirm what account is impacted:

- In this method move towards the option of Chart of Accounts.

- Choose the Include Inactive checkbox.

- Turn off the account:

Windows

- Click on the Lists menu.

- Navigate to the Chart of Accounts option.

- Right-click on the account which is your preference to deactivate.

- Then, hit the Edit button

- Click on the Bank Settings option.

- Select the Deactivate All Online Services.

- Hit the OK button.

- Click the Save & Close button.

Mac

- Click on the Lists menu.

- Navigate to the Chart of Accounts.

- Highlight the account which is required to be deactivated.

- Post that, hit the Pencil icon to go to the Edit option.

- Click on Download Transactions.

- And then choose the Not enabled option.

- Hit OK.

Once you are done disabling the bank feeds, you can set the online banking for every account. This way you can get rid of QuickBooks's error code OL 332.

QuickBooks error OL 332 is a normal error to come across while using online banking. Therefore, in order to get rid of this error, we have provided a number of solutions that might be helpful for you.

Accounting Professionals, CPA, Enterprises, Owners

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-347-428-6831 or chat with experts.

Features of Dancing Numbers for QuickBooks Desktop

Imports

Exports

Deletes

Customization

Supported Entities/Lists

Dancing Numbers supports all QuickBooks entities that are mentioned below:-

Customer Transactions

| Invoice |

| Receive Payment |

| Estimate |

| Credit Memo/Return Receipt |

| Sales Receipt |

| Sales Order |

| Statement Charge |

Vendor Transactions

| Bill |

| Bill Payment |

| Purchase Order |

| Item Receipt |

| Vendor Credit |

Banking Transactions

| Check |

| Journal Entry |

| Deposit |

| Transfer Funds |

| Bank Statement |

| Credit Card Statement |

| Credit Card Charge |

| Credit Card Credit |

Employee Transaction / List

| Time Tracking |

| Employee Payroll |

| Wage Items |

Others

| Inventory Adjustment |

| Inventory Transfer |

| Vehicle Mileage |

Technical Details

Easy Process

Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that you will be able to focus on the core work.

Error Free

Worried about losing time with an error prone software? Our error free add-on enables you to focus on your work and boost productivity.

On-time Support

We provide round the clock technical assistance with an assurance of resolving any issues within minimum turnaround time.

Pricing

Importer, Exporter & Deleter

*See our Pricing for up to 3 Company Files

$199/- Per Year

Pricing includes coverage for users

- Services Include:

- Unlimited Export

- Unlimited Import

- Unlimited Delete

Accountant Basic

*See our Pricing for up to 10 Company Files.

$499/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer,Exporter,Deleter

- Unlimited Users

- Unlimited Records

- Upto 10 companies

Accountant Pro

*See our Pricing for up to 20 Company Files.

$899/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to 20 companies

Accountant Premium

*See our Pricing for up to 50 Company Files.

$1999/- Per Year

Pricing includes coverage for users

- Services Include:

- Importer, Exporter, Deleter

- Unlimited Users

- Unlimited Records

- Up to 50 companies

Dancing Numbers: Case Study

Frequently Asked Questions

How and What all can I Export in Dancing Numbers?

You need to click "Start" to Export data From QuickBooks Desktop using Dancing Numbers, and In the export process, you need to select the type you want to export, like lists, transactions, etc. After that, apply the filters, select the fields, and then do the export.

You can export a Chart of Accounts, Customers, Items, and all the available transactions from QuickBooks Desktop.

How can I Import in Dancing Numbers?

To use the service, you have to open both the software QuickBooks and Dancing Numbers on your system. To import the data, you have to update the Dancing Numbers file and then map the fields and import it.

How can I Delete in Dancing Numbers?

In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option.

How can I import Credit Card charges into QuickBooks Desktop?

First of all, Click the Import (Start) available on the Home Screen. For selecting the file, click on "select your file," Alternatively, you can also click "Browse file" to browse and choose the desired file. You can also click on the "View sample file" to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields. To review your file data on the preview screen, just click on "next," which shows your file data.

Which file types are supported by Dancing Numbers?

XLS, XLXS, etc., are supported file formats by Dancing Numbers.

What is the pricing range of the Dancing Numbers subscription Plan?

Dancing Numbers offers four varieties of plans. The most popular one is the basic plan and the Accountant basic, the Accountant pro, and Accountant Premium.

How can I contact the customer service of Dancing Numbers if any issue arises after purchasing?

We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues.

How can I Import Price Level List into QuickBooks Desktop through Dancing Numbers?

First, click the import button on the Home Screen. Then click "Select your file" from your system. Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file.

To review your file data on the preview screen, just click on "next," which shows your file data.

What are some of the features of Dancing Numbers to be used for QuickBooks Desktop?

Dancing Numbers is SaaS-based software that is easy to integrate with any QuickBooks account. With the help of this software, you can import, export, as well as erase lists and transactions from the Company files. Also, you can simplify and automate the process using Dancing Numbers which will help in saving time and increasing efficiency and productivity. Just fill in the data in the relevant fields and apply the appropriate features and it's done.

Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

Why should do you change the Employee status instead of deleting them on QuickBooks?

If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your accounting database without any data loss in your tax payments.

Is it possible to use the Direct Connect option to sync bank transactions and other such details between Bank of America and QuickBooks?

Yes, absolutely. You can use the Direct Connect Option by enrolling for the Direct Connect service which will allow you access to the small business online banking option at bankofamerica.com. This feature allows you to share bills, payments, information, and much more.

Why should do you change the Employee status instead of deleting them on QuickBooks?

If you are unable to see the option to terminate an employee on your list of active employees on the company payroll, this mostly implies that they have some history. Thus, if you change the employee status instead of deleting it on QuickBooks, the profile and pay records remain in your accounting database without any data loss in your tax payments.

What are the various kinds of accounts you could access in QuickBooks?

QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts.

Get Support

Bulk import, export, and deletion can be performed with simply one-click. A simplified process ensures that you will be able to focus on the core work.

Worried about losing time with an error prone software? Our error free add-on enables you to focus on your work and boost productivity.

rodrigueswastures1945.blogspot.com

Source: https://www.dancingnumbers.com/quickbooks-error-ol-332/

0 Response to "Quickbooks Bank Feeds Received Instead of Spent"

Postar um comentário